Atlas Engineered Products Reports Record First Quarter Financial and Operating Results

Atlas Engineered Products (“AEP” or the “Company”) (OTC Markets: APEUF) is pleased to announce its financial and operating results for the three months ended March 31, 2022. All amounts are presented in Canadian dollars.

“I continue to be proud of the AEP team that produced another solid quarter while dealing with a myriad of challenges, including materials and labor shortages and fluctuating market prices. The construction industry continues to be strong as we head in to the busier seasons where the bulk of construction occurs during the year,” said Hadi Abassi, CEO & President, Founder. “We will continue working to improve efficiencies that will allow us to take advantage of this strong construction industry and help fill the need for housing across Canada.”

Financial Highlights for Q1 2022:

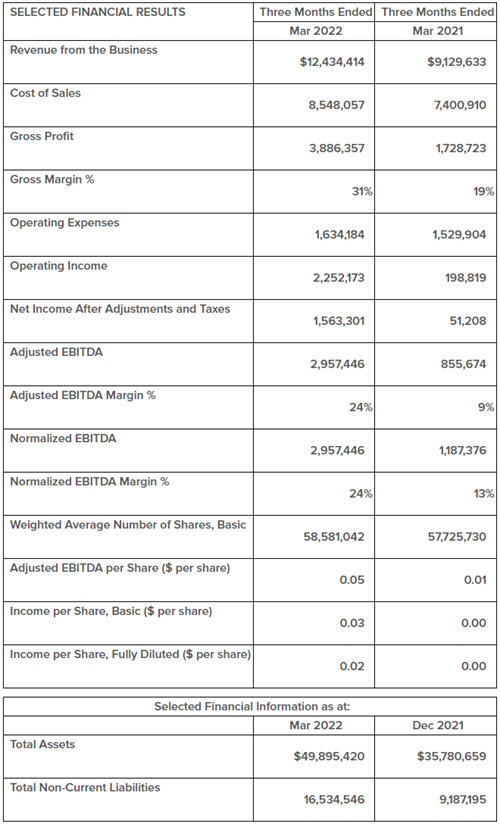

- Revenue increased 35% to $12,434,414 for the three months ended March 31, 2022 from $9,219,633 for the three months ended March 31, 2021. This increase now represents the Company’s best first quarter to date.

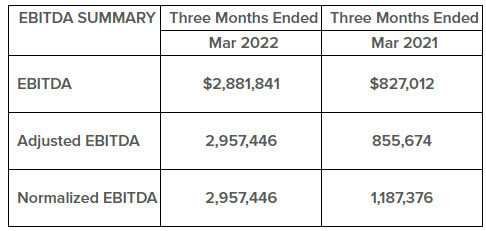

- Non-IFRS EBITDA for the three months ended March 31, 2022 was $2,881,841, with an EBITDA margin of 23%. EBITDA for the three months ended March 31, 2021 was $827,012, with an EBITDA margin of 9%. EBITDA and EBITDA margin for the three months ended March 31, 2022 increased compared to the three months ended March 31, 2021 due to increased net income for the period resulting from increased sales and improved gross margins.

- Gross margin for the three months ended March 31, 2022 was 31%, which was up from a gross margin of 19% for the three months ended March 31, 2021. Gross margins improved compared to the prior period due to the pricing assessments resulting from the passing through of increasing raw material costs to the customers, as well as, operational efficiency improvements. Due to the high demand in the market, there was also less of a need to take on “winter work” at lower margins in order to keep skilled labor employed and the locations busy.

- Net income was $1,563,301 for the three months ended March 31, 2022 compared to net income of $51,208 for the three months ended March 31, 2021. This increase was primarily due to the significant increase in sales, improvements in gross margin, and the new acquisition of Hi-Tec Industries Ltd. (“Hi-Tec”).

Expansion for 2022

On February 28, 2022, the Company acquired Hi-Tec (“Hi-Tec Acquisition”), located in Lantzville, BC on Vancouver Island. The shares of Hi-Tec were acquired for $5.8 million in cash, with a working capital adjustment of $454,981 that was finalized subsequent to the three months ended March 31, 2022. The land and buildings of Hi-Tec were also acquired by the Company for the appraised value of $3.25 million in cash. The Company financed the Hi-Tec Acquisition with a term loan for $5.8 million and a mortgage for $2,437,500. During its last fiscal year ended August 31, 2021, Hi-Tec earned unaudited revenues of just over $5.0 million, net income before taxes of just over $1.0 million, and a normalized EBITDA of $1.25 million, resulting in a normalized EBITDA margin of 25%. (Financial information for Hi-Tec for the year ended August 31, 2021 was unaudited and unreviewed.)

Since purchasing Hi-Tec Industries on February 28, 2022, this operation contributed $627,459 in revenues and approximately $171,669 in EBITDA for the three months ended March 31, 2022.

Normal Course Issuer Bid (“NCIB”) Update:

From the commencement of the NCIB on November 3, 2021, the Company has acquired 883,500 shares for cancellation. The NCIB is ongoing until November 3, 2022 and the Company may purchase up to 2,886,286 common shares of the Company. All purchases of common shares will be made on the open market through the facilities of the TSXV and will be purchased for cancellation.

AEP’s board of directors continues to believe that the current market price for the Company’s common shares do not currently reflect the underlying value of the Company. As a result, depending on the future price movements and other factors, AEP’s board of directors believes that the purchase of the shares is an appropriate use of AEP’s funds and in the best interests of AEP’s shareholders.

For the complete press release, click here.

About Atlas Engineered Products Ltd.

AEP is a growth company that is acquiring and operating profitable, well-established operations in Canada’s truss and engineered products industry. We have a well-defined and disciplined acquisition and operating growth strategy enabling us to scale aggressively and apply new technologies, giving us a unique opportunity to consolidate a fragmented industry of independent operators.

Source: Atlas Engineered Products Ltd.