Freddie Mac: Mortgage Rates Tick Down

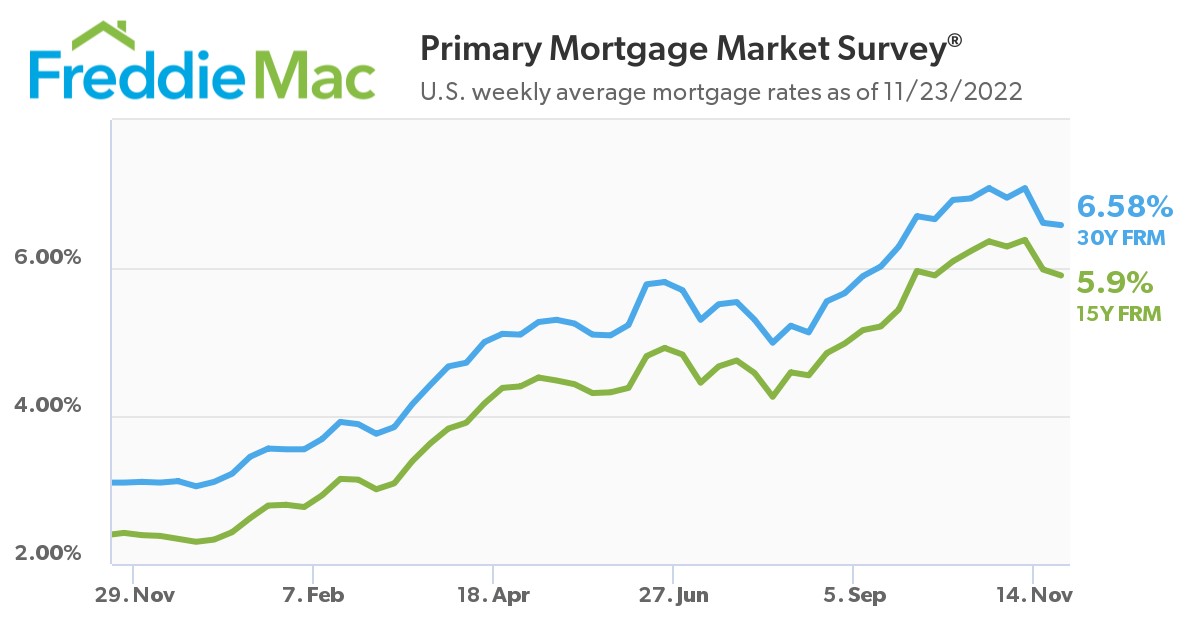

Freddie Mac released the results of its Primary Mortgage Market Survey (“PMMS”), showing the 30-year fixed-rate mortgage (“FRM”) averaged 6.58 percent. This week’s results include an adjustment for the observance of Thanksgiving.

“Mortgage rates continued to tick down heading into the Thanksgiving holiday,” said Sam Khater, Freddie Mac’s Chief Economist. “In recent weeks, rates have hit above seven percent only to drop by almost half a percentage point. This volatility is making it difficult for potential homebuyers to know when to get into the market, and that is reflected in the latest data which shows existing home sales slowing across all price points.”

News Facts

- 30-year fixed-rate mortgage averaged 6.58 percent as of November 23, 2022, down from last week when it averaged 6.61 percent. A year ago at this time, the 30-year FRM averaged 3.10 percent.

- 15-year fixed-rate mortgage averaged 5.90 percent, down from last week when it averaged 5.98 percent. A year ago at this time, the 15-year FRM averaged 2.42 percent.

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit. For more information, view our Frequently Asked Questions.

Freddie Mac makes home possible for millions of families and individuals by providing mortgage capital to lenders. Since our creation by Congress in 1970, we’ve made housing more accessible and affordable for homebuyers and renters in communities nationwide. We are building a better housing finance system for homebuyers, renters, lenders, investors and taxpayers. Learn more at FreddieMac.com, Twitter @FreddieMac and Freddie Mac’s blog FreddieMac.com/blog.

Contact:

Angela Waugaman – Media Contact – Angela_Waugaman@FreddieMac.com – (703) 714-0644

Source: Freddie Mac