Freddie Mac: Mortgage Rates Inch Down

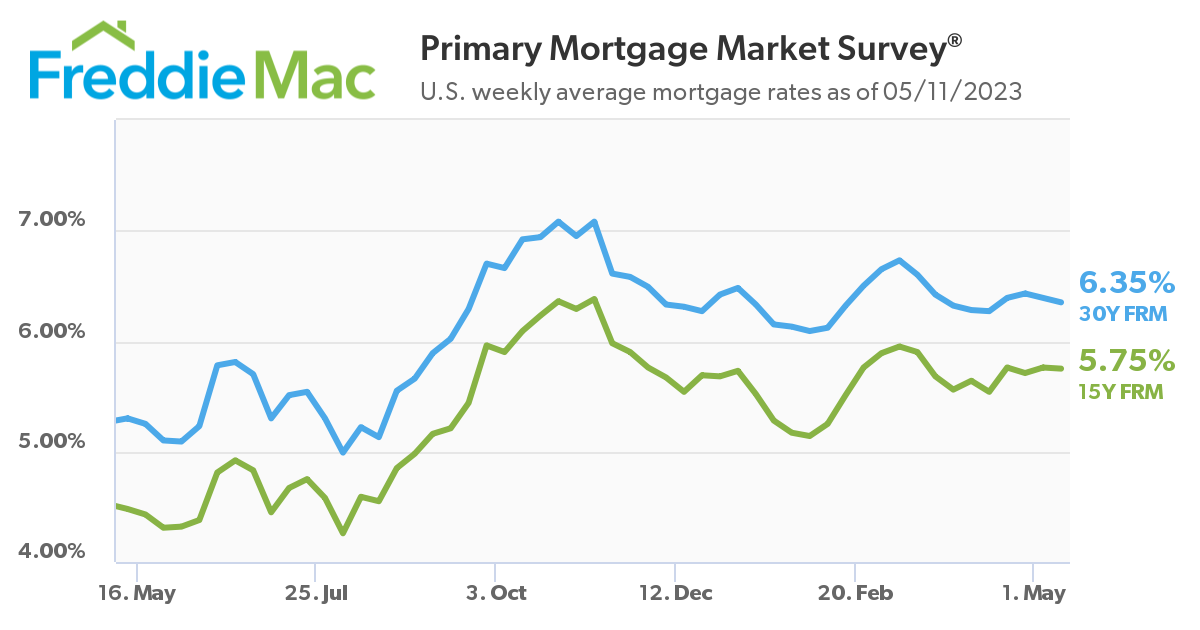

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey (PMMS), showing the 30-year fixed-rate mortgage (FRM) averaged 6.35 percent.

“This week’s decrease continues a recent sideways trend in mortgage rates, which is a welcome departure from the record increases of last year,” said Sam Khater, Freddie Mac’s Chief Economist. “While inflation remains elevated, its rate of growth has moderated and is expected to decelerate over the remainder of 2023. This should bode well for the trajectory of mortgage rates over the long-term.”

News Facts

- 30-year fixed-rate mortgage averaged 6.35 percent as of May 11, 2023, down from last week when it averaged 6.39 percent. A year ago at this time, the 30-year FRM averaged 5.30 percent.

- 15-year fixed-rate mortgage averaged 5.75 percent, down slightly from last week when it averaged 5.76 percent. A year ago at this time, the 15-year FRM averaged 4.48 percent.

The PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit. For more information, view our Frequently Asked Questions.

About Freddie Mac

Freddie Mac’s mission is to make home possible for families across the nation. We promote liquidity, stability, affordability and equity in the housing market throughout all economic cycles. Since 1970, we have helped tens of millions of families buy, rent or keep their home. Learn More: Website | Consumers | Twitter | LinkedIn | Facebook | Instagram | YouTube

Contact:

Angela Waugaman – Media Contact – Angela_Waugaman@FreddieMac.com – (703) 714-0644

Source: Freddie Mac