Rayonier Reports Third Quarter 2023 Results

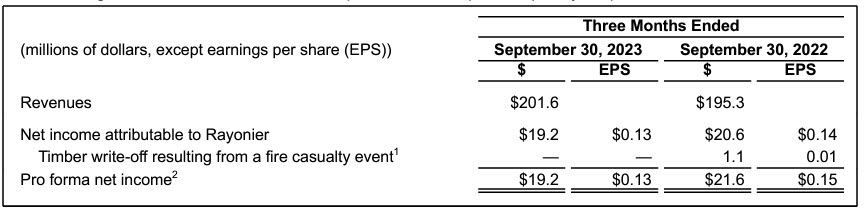

Rayonier Inc. (NYSE:RYN) today reported third quarter net income attributable to Rayonier of $19.2 million, or $0.13 per share, on revenues of $201.6 million. This compares to net income attributable to Rayonier of $20.6 million, or $0.14 per share, on revenues of $195.3 million in the prior year quarter. The prior year quarter included a $1.1 million timber write-off resulting from a fire casualty event in Washington.1 Excluding this item, pro forma net income2 was $21.6 million, or $0.15 per share, in the prior year period.

The following table summarizes the current quarter and comparable prior year period results:

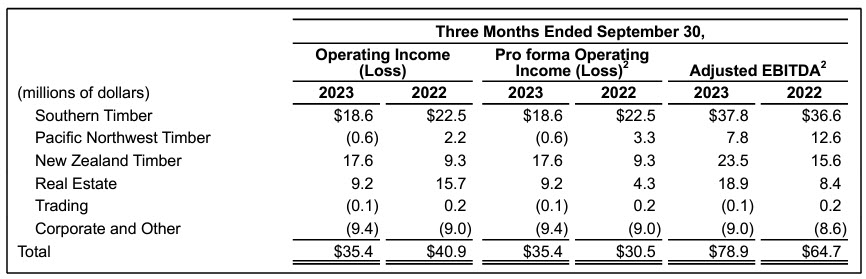

Third quarter operating income was $35.4 million versus $40.9 million in the prior year period, which included a $16.0 million gain on the sale of a multi-family apartment complex in Bainbridge Island, Washington, held in a joint venture acquired as part of the Pope Resources transaction. Excluding $11.5 million of this gain attributable to noncontrolling interests3 and the $1.1 million timber write-off resulting from a casualty event,1 prior year third quarter pro forma operating income2 was $30.5 million. Third quarter Adjusted EBITDA2 was $78.9 million versus $64.7 million in the prior year period.

The following table summarizes operating income (loss), pro forma operating income (loss),2 and Adjusted EBITDA2 for the current quarter and comparable prior year period:

Year-to-date cash provided by operating activities was $208.9 million versus $209.9 million in the prior year period. Year-to-date cash available for distribution (CAD)2 was $113.5 million, which decreased $45.3 million versus the prior year period due to lower Adjusted EBITDA2 ($42.9 million), higher cash interest paid ($7.4 million) and higher capital expenditures ($4.9 million), partially offset by lower cash taxes paid ($10.0 million).

“We generated strong third quarter results, particularly in light of the macroeconomic challenges that continue to adversely impact our timber businesses,” said David Nunes, CEO. “Adjusted EBITDA improved 22% versus the prior year quarter, primarily driven by a stronger contribution from our Real Estate segment and increased carbon credit sales in our New Zealand Timber segment. Total Adjusted EBITDA for our collective timber segments increased 7% versus the prior year period, as favorable results in our Southern Timber and New Zealand Timber segments more than offset lower Adjusted EBITDA in our Pacific Northwest Timber segment. Meanwhile, our Real Estate segment registered a significant increase in Adjusted EBITDA versus the prior year period, reflecting continued momentum in our improved development projects and strong ongoing demand for rural properties, despite the higher interest rate environment.”

“In our Southern Timber segment, Adjusted EBITDA improved by $1.2 million as harvest volumes increased 21% relative to the prior year quarter, primarily due to the successful integration of the acquisitions completed in late 2022. The higher volumes were partially offset by a 17% decline in weighted-average net stumpage prices due to weaker demand and drier weather conditions as compared to the prior year period.”

“In our Pacific Northwest Timber segment, Adjusted EBITDA declined $4.8 million from the prior year quarter as weaker domestic and export demand led to a 10% decline in domestic sawtimber prices versus the prior year period. Further, harvest volumes declined 6% relative to the prior year quarter as we deferred some harvest activity due to continued market headwinds.”

“In our New Zealand Timber segment, Adjusted EBITDA improved $7.9 million versus the prior year quarter as significantly higher carbon credit sales were partially offset by 3% lower harvest volumes and 2% lower net stumpage realizations as compared to the prior year period.”

“In our Real Estate segment, Adjusted EBITDA was up $10.5 million versus the prior year quarter, due to a significant increase in acres sold at higher per-acre prices compared to the prior year period.”

Southern Timber

Third quarter sales of $64.0 million decreased $0.6 million, or 1%, versus the prior year period. Harvest volumes increased 21% to 1.81 million tons versus 1.50 million tons in the prior year period, primarily driven by additional volume from acquisitions completed in the fourth quarter of 2022. Average pine sawtimber stumpage realizations decreased 13% to $28.85 per ton versus $33.31 per ton in the prior year period, primarily due to drier weather conditions, softer demand from sawmills, and decreased competition from pulp mills for chip-nsaw volume. Average pine pulpwood stumpage realizations decreased 27% to $16.54 per ton versus $22.77 per ton in the prior year period due to weaker end-market demand and drier weather conditions. Overall, weighted-average stumpage realizations (including hardwood) decreased 17% to $21.48 per ton versus $25.80 per ton in the prior year period. Operating income of $18.6 million decreased $3.8 million versus the prior year period due to lower net stumpage realizations ($7.8 million), higher depletion rates ($2.2 million), and higher overhead and other costs ($1.7 million), partially offset by higher volumes ($5.0 million) and higher non-timber income ($2.8 million).

Third quarter Adjusted EBITDA2 of $37.8 million was 3%, or $1.2 million, above the prior year period.

Pacific Northwest Timber

Third quarter sales of $29.3 million decreased $5.1 million, or 15%, versus the prior year period. Harvest volumes decreased 6% to 290,000 tons versus 307,000 tons in the prior year period, as some planned harvests were deferred in response to soft market conditions. Average delivered prices for domestic sawtimber decreased 10% to $108.20 per ton versus $120.08 per ton in the prior year period due to weaker domestic and export market demand. Average delivered pulpwood prices decreased 35% to $33.09 per ton versus $50.74 per ton in the prior year period, as the prior year period benefited from much stronger end-market demand. An operating loss of $0.6 million versus operating income of $2.2 million in the prior year period was driven by lower net stumpage realizations ($2.4 million), higher costs ($1.2 million), lower volumes ($0.4 million) and lower non-timber income ($0.3 million), partially offset by lower depletion rates ($0.4 million) and the prior year period write-off of timber basis due to a fire in Washington1 ($1.1 million).

Third quarter Adjusted EBITDA2 of $7.8 million was 38%, or $4.8 million, below the prior year period.

New Zealand Timber

Third quarter sales of $70.4 million decreased $2.0 million, or 3%, versus the prior year period. Harvest volumes decreased 3% to 690,000 tons versus 712,000 tons in the prior year period, as some planned harvests were deferred in response to soft market conditions. Average delivered prices for export sawtimber decreased 23% to $95.23 per ton versus $123.07 per ton in the prior year period, primarily due to weaker demand in China and increased supply from Cyclone Gabrielle salvage volume. Despite the significant decline in delivered pricing, export sawtimber net stumpage realizations were down only 4% due to significantly lower port and freight costs versus the prior year period. Average delivered prices for domestic sawtimber declined 9% to $63.45 per ton versus $69.69 per ton in the prior year period. The decrease in domestic sawtimber prices (in U.S. dollar terms) was driven in part by the decline in the NZ$/US$ exchange rate (US$0.61 per NZ$1.00 versus US$0.62 per NZ$1.00). Excluding the impact of foreign exchange rates, domestic sawtimber prices decreased 7% versus the prior year period, reflecting weaker domestic demand and decreased competition from export markets. Third quarter non-timber / carbon credit sales totaled $15.6 million versus $6.4 million in the prior year period, as increased volumes were sold into the market following a significant uptick in NZU pricing. Operating income of $17.6 million increased $8.3 million versus the prior year period primarily due to higher carbon credit sales ($9.3 million), partially offset by lower net stumpage realizations ($0.7 million) and lower volumes ($0.3 million).

Third quarter Adjusted EBITDA2 of $23.5 million was 51%, or $7.9 million, above the prior year period.

Real Estate

Third quarter sales of $31.2 million increased $18.7 million versus the prior year period, while operating income of $9.2 million decreased $6.6 million versus the prior year period. Prior year third quarter operating income included an $11.5 million gain attributable to noncontrolling interests3 associated with the Bainbridge Island multi-family apartment complex sale. Excluding this item, pro forma operating income2 was $4.3 million in the prior year period. Sales and pro forma operating income2 increased versus the prior year period primarily due to a higher number of acres sold (4,281 acres sold versus 1,828 acres sold in the prior year period) and an increase in weighted-average prices ($5,781 per acre versus $5,064 per acre in the prior year period).

Improved Development sales of $3.1 million included $1.8 million from the Heartwood development project south of Savannah, Georgia and $1.4 million from the Wildlight development project north of Jacksonville, Florida. Sales in Heartwood consisted of 24 finished residential lots for $1.1 million ($45,000 per lot or $290,000 per acre) and a 1.3-acre commercial parcel to be used for a quick-service restaurant for $0.7 million ($531,000 per acre). Sales in Wildlight consisted of a 2-acre commercial parcel to be used for a convenience store for $1.4 million ($735,000 per acre). This compares to Improved Development sales of $2.3 million in the prior year period.

Unimproved Development sales of $0.1 million consisted of a 10-acre transaction for $11,250 per acre. There were no Unimproved Development sales in the prior year period.

Rural sales of $20.5 million consisted of 3,799 acres at an average price of $5,386 per acre. This compares to prior year period sales of $7.0 million, which consisted of 1,809 acres at an average price of $3,848 per acre.

Timberland & Non-Strategic sales of $1.1 million consisted of 466 acres at an average price of $2,266 per acre. There were no Timberland & Non-Strategic sales in the prior year period.

Third quarter Adjusted EBITDA2 of $18.9 million increased $10.5 million versus the prior year period.

Trading

Third quarter sales of $6.8 million decreased $4.8 million versus the prior year period due to lower volumes and prices. Sales volumes decreased 35% to 61,000 tons versus 95,000 tons in the prior year period. The Trading segment generated an operating loss of $0.1 million versus operating income of $0.2 million in the prior year period.

Other Items

Third quarter corporate and other operating expenses of $9.4 million increased $0.5 million versus the prior year period, primarily driven by higher compensation and benefits expenses.

Third quarter interest expense of $12.6 million increased $3.5 million versus the prior year period, primarily due to higher average outstanding debt and a higher weighted-average interest rate.

Third quarter income tax expense of $0.6 million decreased $0.7 million versus the prior year period. The New Zealand subsidiary is the primary driver of income tax expense.

Outlook

“Based on our year-to-date results and our expectations for the fourth quarter, we now expect that full-year Adjusted EBITDA will be toward the higher end of our prior guidance range,” added Nunes. “In our Southern Timber segment, we expect full-year Adjusted EBITDA toward the higher end of our prior guidance range due to an improved outlook for non-timber income. In our Pacific Northwest Timber segment, we expect full-year Adjusted EBITDA toward the lower end of our prior guidance range due to continued softness in end-market demand and lower anticipated harvest volumes. In our New Zealand Timber segment, we expect full-year Adjusted EBITDA toward the higher end of our prior guidance range due to an improved outlook for carbon credit sales. In our Real Estate segment, we anticipate full-year Adjusted EBITDA toward the higher end of our prior guidance range based on increased transaction volume expected to close in the fourth quarter.”

For the complete press release, click here.

About Rayonier

Rayonier (NYSE:RYN) is a leading timberland real estate investment trust with assets located in some of the most productive softwood timber growing regions in the United States and New Zealand. As of September 30, 2022, Rayonier owned or leased under long-term agreements approximately 2.7 million acres of timberlands located in the U.S. South (1.79 million acres), U.S. Pacific Northwest (486,000 acres) and New Zealand (417,000 acres). More information is available at www.rayonier.com.

Contact:

Collin Mings – Media Contact – (904) 357-9100 – investorrelations@rayonier.com

Source: Rayonier, Inc.