CoreLogic: Rent Growth Slows to Lowest Rate in Four Years

The Pandemic-led Rent Growth Boom is Beginning to Fizzle

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas. The report highlights the slowing growth in key rental metros which all experienced population spikes during the pandemic.

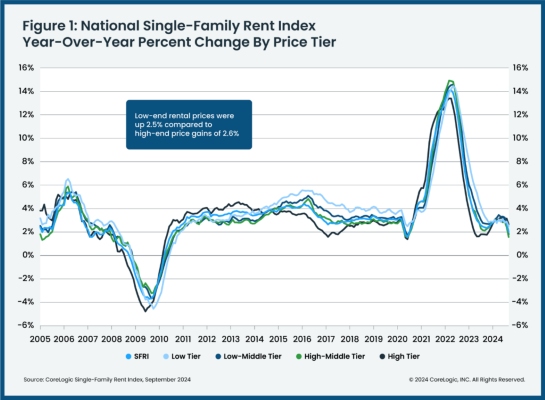

Annual U.S. rent growth registered a 2% increase in September, continuing a slowing trend that began in early 2024 but is well below the average annual rent growth of 3.5% that occurred in the decade prior to the pandemic. High-end price growth (2.6%) slightly outstripped low-end gains, a sign that some renters are leveraging advantageous economic conditions to upgrade – including wages that are up buy 40% since last September.

“Single-family annual rent growth slowed in September to the lowest rate in over four years, and monthly rent growth posted a second month of below-seasonal trend growth, making it clear that single-family rent growth is decelerating,” said CoreLogic principal economist Molly Boesel. “While about one-third of metros showed stronger rent growth than in the previous year, more metros showed decreases in rents than in the prior report. While a slowing in rents will be welcome news to renters, increases since 2020 are still at 32%.”

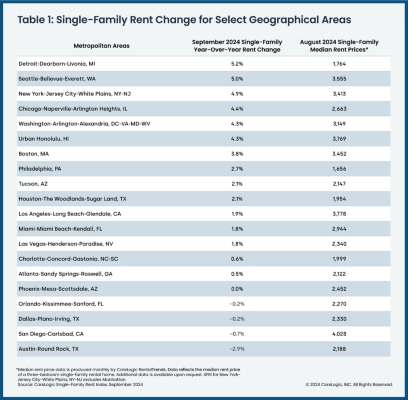

Of the top 20 CBSA that CoreLogic tracks, two posted gains of 5% or greater, and seven metro areas had median rents above $3,000.

Of the 20 metros shown in Table 1, Detroit posted the highest year-over-year increase in single-family rents in September 2024, at 5.2%, followed by Seattle (5%). Austin, Texas saw rents fall by -2.9% year over year, followed by San Diego (-0.7%).

The next CoreLogic Single-Family Rent Index is scheduled to be released on December 19, 2024, featuring data for October 2024. For ongoing housing trends and data, visit the CoreLogic Intelligence Blog.

Methodology

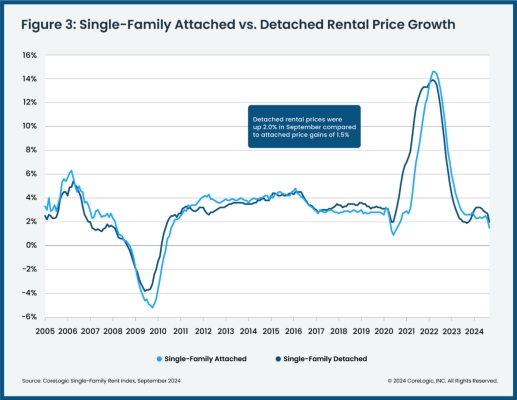

The single-family rental market accounts for half of the rental housing stock, yet unlike the multifamily market, which has many different sources of rent data, there are minimal quality adjusted single-family rent transaction data. The CoreLogic Single-Family Rent Index (SFRI) serves to fill that void by applying a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service. The rental listings used to calculate the index include both attached and detached single-family homes, as well as condominiums. CoreLogic constructed the SFRI for close to 100 metropolitan areas — including 43 metros with four value tiers — and a national composite index. The indices are fully revised with each release to signal turning points sooner.

The CoreLogic Single-Family Rent Index analyzes data across four price tiers: Lower-priced, which represent rentals with prices 75% or below the regional median; lower-middle, 75% to 100% of the regional median; higher-middle, 100%-125% of the regional median; and higher-priced, 125% or more above the regional median.

Median rent price data is produced monthly by CoreLogic Rental Trends. Rental Trends is built on a database of more than 11 million rental properties (over 75% of all U.S. individual owned rental properties) and covers all 50 states and 17,500 ZIP codes.

About CoreLogic

CoreLogic is a leading provider of property insights and innovative solutions, working to transform the property industry by putting people first. Using its network, scale, connectivity and technology, CoreLogic delivers faster, smarter, more human-centered experiences that build better relationships, strengthen businesses and ultimately create a more resilient society. For more information, please visit www.corelogic.com.

CORELOGIC, the CoreLogic logo, CoreLogic HPI and CoreLogic HPI Forecast are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

Contact:

Robin Wachner – Media Contact – newsmedia@corelogic.com

Source: CoreLogic, Inc.