Madison’s Reporter: Lumber Prices Drop Again as Customer Reluctance Continues

As the second half of summer 2021 came on, there was no more clarity on the state of the North American construction framing dimension softwood lumber market than there had been for most of this year. While building, and especially housing market, activity continued relatively strong, it seemed that quite a bit of that higher-cost inventory remained in the field. So wholesalers, retailers, and end-users held off purchasing as long as they could, once again, in hopes that prices might fall further. Sawmill curtailments and downtime — in British Columbia and Quebec respectively — seemed to have not the slightest effect on customer motivation to buy lumber.

The latest release on US new home sales and house prices was quite positive. Indeed, 77% of homes sold in July were either still under construction or yet to be built, up from an incredible 76% in June. This is a phenomenal ratio and indicates much strength in US home building still to come.

Ticking down slightly from a rebound the previous week, in the week of August 6, 2021, the price of Western S-P-F 2×4 #2&Btr KD (RL) was US$539 mfbm. This is down by -$6, or -1%, from the previous week when it was $545. That week’s price is down by -$85, or -14%, from one month ago when it was $624.

Buyers weighed the potential supply problems and logistical interruptions caused by wildfires against the possibility of further downside in prices and many decided to watch and wait.

“Prices of dimension and studs appeared to be stabilizing while panels were in a nightmare downward spiral.” – Madison’s Lumber Reporter

Western S-P-F demand in the US was steady if unimpressive. Of course, most had bought some volume on the way down and weren’t in a particularly urgent position in terms of inventory. Demand for low grade was especially soft, sawmills reduced their asking prices accordingly.

While demand, and resultant sales volumes, of Western S-P-F dimension lumber in Canada improved, prices remained all over the shop. Demand for narrows was most active.

“The month of August kicked off with strong demand according to Eastern S-P-F suppliers. While inquiry was much improved, it didn’t necessarily translate into greater sales volumes, especially early in the week when customers were mostly kicking tires and assessing their inventory positions.” – Madison’s Lumber Reporter

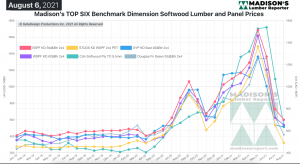

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages

Compared to the same week last year, when it was US$666 mfbm, for the week ending July 30, 2021, the price of Western S-P-F 2×4 #2&Btr KD (RL) is down by -$127, or -19%. Compared to two years ago when it was $340, that week’s price is up by $199, or +59%.

About Madison’s Lumber Reporter

Established in 1952, Madison’s Lumber Prices is your premiere source for North American softwood lumber news, prices, industry insight, and industry contacts. The weekly Madison’s Lumber Reporter publishes current Canadian and US construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and access to historical pricing as well.

Contact:

Keta Kosman – Publisher, Madison’s Lumber Reporter – (604) 319-2266 –www.madisonsreport.com

Source: Madison’s Lumber Reporter