Freddie Mac: Mortgage Rates Increase Slightly in Latest Report

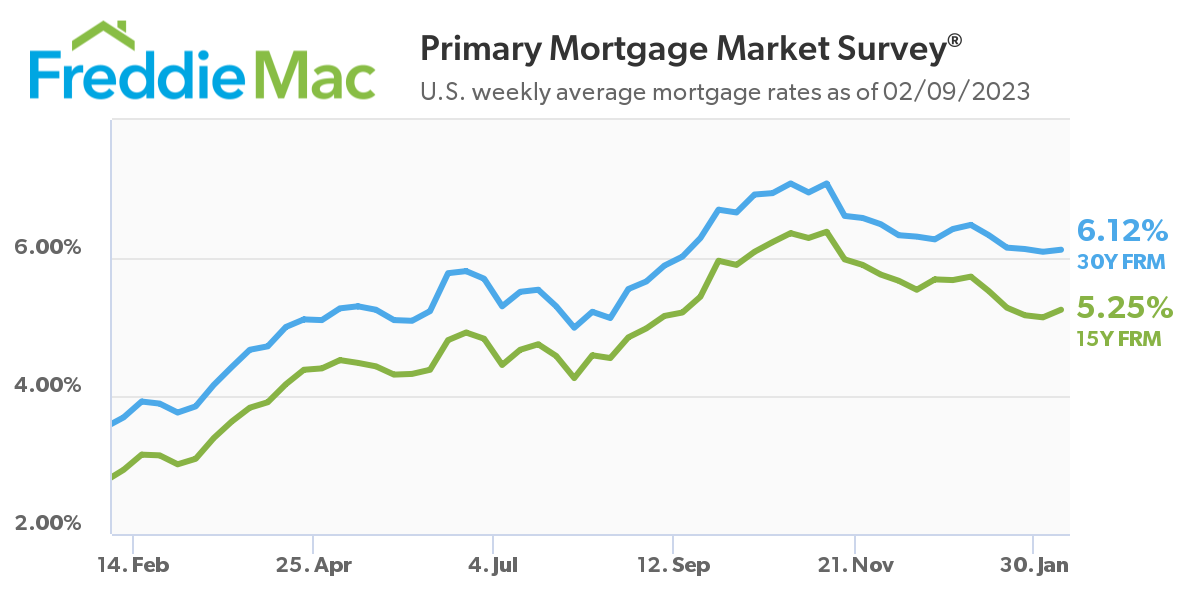

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.12 percent.

“Following an interest rate hike from the Federal Reserve and a surprisingly strong jobs report, mortgage rates increased slightly this week,” said Sam Khater, Freddie Mac’s Chief Economist. “The 30-year fixed-rate continues to hover close to six percent, and interested homebuyers are easing their way back to the market just in time for the spring homebuying season.”

News Facts

- 30-year fixed-rate mortgage averaged 6.12 percent as of February 9, 2023, up from last week when it averaged 6.09 percent. A year ago at this time, the 30-year FRM averaged 3.69 percent.

- 15-year fixed-rate mortgage averaged 5.25 percent, up from last week when it averaged 5.14 percent. A year ago at this time, the 15-year FRM averaged 2.93 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit. For more information, view our Frequently Asked Questions.

About Freddie Mac

Freddie Mac makes home possible for millions of families and individuals by providing mortgage capital to lenders. Since our creation by Congress in 1970, we’ve made housing more accessible and affordable for homebuyers and renters in communities nationwide. We are building a better housing finance system for homebuyers, renters, lenders, investors and taxpayers. Learn more at FreddieMac.com, Twitter @FreddieMac and Freddie Mac’s blog FreddieMac.com/blog.

Contact:

Angela Waugaman – Media Contact – Angela_Waugaman@FreddieMac.com – (703) 714-0644

Source: Freddie Mac