Madison’s Reporter: Lumber Prices Flatten as Winter Ends

By mid-March many regions across the continent faced yet another bought of bad weather. Meanwhile the densely-populated southern US states ramped up construction activity. Demand for lumber materials remained somewhat muted, yet suppliers booked enough sales to keep prices generally even from the previous week. Sawmills claimed to have extended order files out to two weeks or so, but resellers suspected this might be an exaggeration. However, the ability of manufacturers to dismiss counter-offers suggested their order files would stretch out that far soon enough. Transportation delays continued as harsh weather remained for another week.

Check back with the Madison’s website www.madisonsreport.com regularly to be informed of what to look for next.

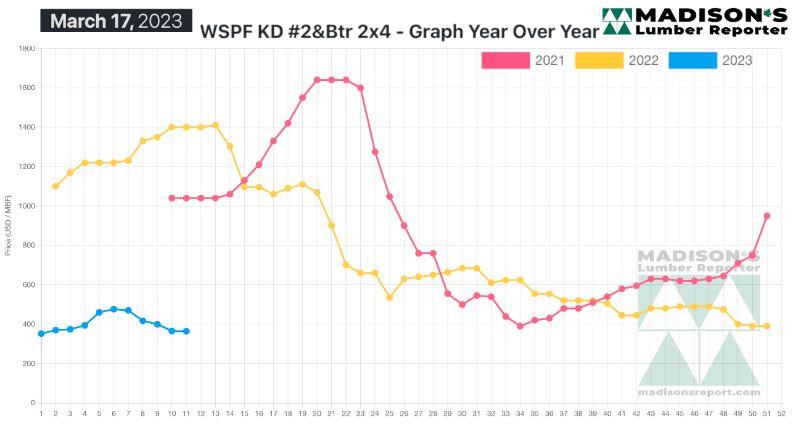

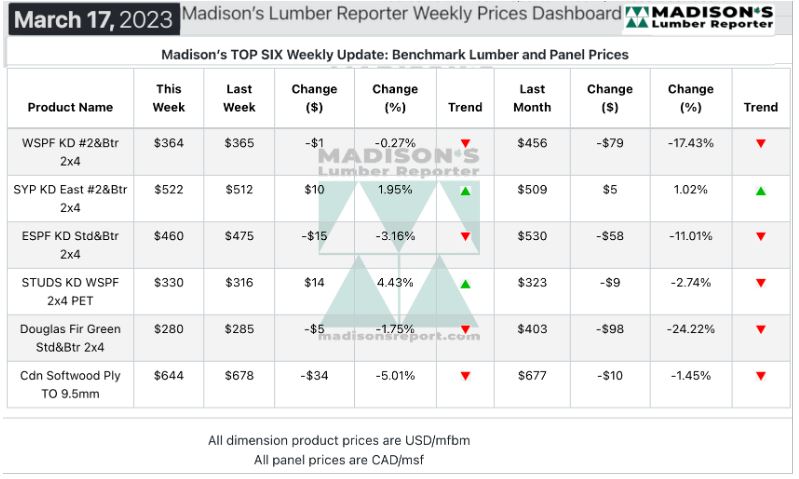

In the week ending March 17, 2023, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$364 mfbm, which is down by -$1 or 0%, from the previous week when it was US$365 mfbm, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. This is down by -$91, or -20%, from one month ago when it was $456.

Demand for standard dimension lumber improved a little, while sales of panels continued to languish by comparison.

“The effects of winter weather still abounded, especially in production regions where frigid temperatures persistently hampered timber harvesting and log transportation.” – Madison’s Lumber Reporter

Amid a mushy market, Western S-P-F traders in the US saw better sales volumes in mid-March. Producers showed a little more confidence as they kept asking prices at or on either side of the previous week’s levels. Despite the banking tumult, buyers actively sought near-term coverage to fill holes in their inventories. Players voiced their concerns that government intervention in the financial system would negatively affect investment and growth in the housing sector. Having done enough business to extend order files into the first week of April, producers were decreasingly interested in accepting counter-offers.

Western S-P-F lumber prices in Western Canada stabilized as suppliers reported a more balanced supply-demand equation. Sales of low grade continued to outperform standard and high grade. Industrial customers stayed more active than those in the #2&Btr game. While the spring building boost has yet to materialize, suppliers were more confident in its imminence due to long-term forecasts showing warmer weather patterns in many key areas.

Demand for Eastern S-P-F panel market was much the same as the previous week, with the added disincentive of tumbling plywood prices. Buyers smelled blood and were happy to wait and see how much further this correction might go. Oriented Strand Board prices were flat amid a tale of two markets; where demand out of Eastern Canada remained snowed under for the time being while several key markets south of the border were lumbering to life. Inventory holders in Ontario and Quebec hoped for warmer weather to melt away the snow piles eating up their yard space. Suppliers of OSB and plywood in Western Canada didn’t have much new to report. Wholesalers and distributers in Lower Mainland British Columbia were able to buy OSB cheaper than print levels for the first time in several weeks. Prices of plywood meanwhile stumbled around five points as producers approached their alleged early-April order files and tried to drum up some interest. Late shipments were commonly reported.” – Madison’s Lumber Reporter

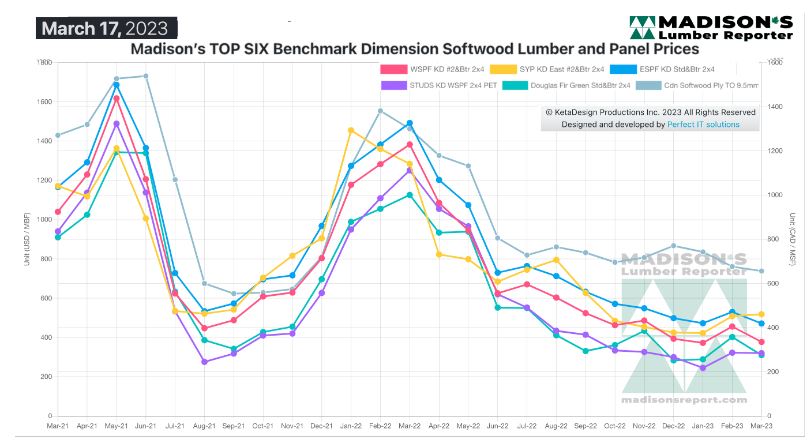

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages

Compared to the same week last year, when it was US$1,330 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending March 17, 2023 this price was down by -$966, or -73%. Compared to two years ago when it was $1,040, that week’s price is down by -$676, or -65%.

About Madison’s Lumber Reporter

Established in 1952, Madison’s Lumber Prices is your premiere source for North American softwood lumber news, prices, industry insight, and industry contacts. The weekly Madison’s Lumber Reporter publishes current Canadian and US construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and access to historical pricing as well.

Contact:

Keta Kosman – Publisher, Madison’s Lumber Reporter – (604) 319-2266 –www.madisonsreport.com

Source: Madison’s Lumber Reporter