Madison’s Reporter: Increased Housing Construction Activity Brings Higher Lumber Prices

True housing construction activity finally got going across the North American continent as the month of June closed. Many builders found themselves short of the lumber supply they would need for existing projects. While no one was yet building inventory, the availability of wood remained quite tight due to ongoing sawmill curtailments and lessened production volumes. Customers struggled to locate the wood they needed from wholesalers and secondary suppliers. Demand increased to the point that lumber prices once again rose slightly. Expectations about industry is that, as lumber sales continue to increase, more sawmills and going to ramp up production volumes to bring more lumber manufacturing online. Into the next couple of months, as supply improves to meet demand, lumber prices should stabilize. Then it will start to become clear where the new price floor for lumber is; we will start to see what is the “new normal”.

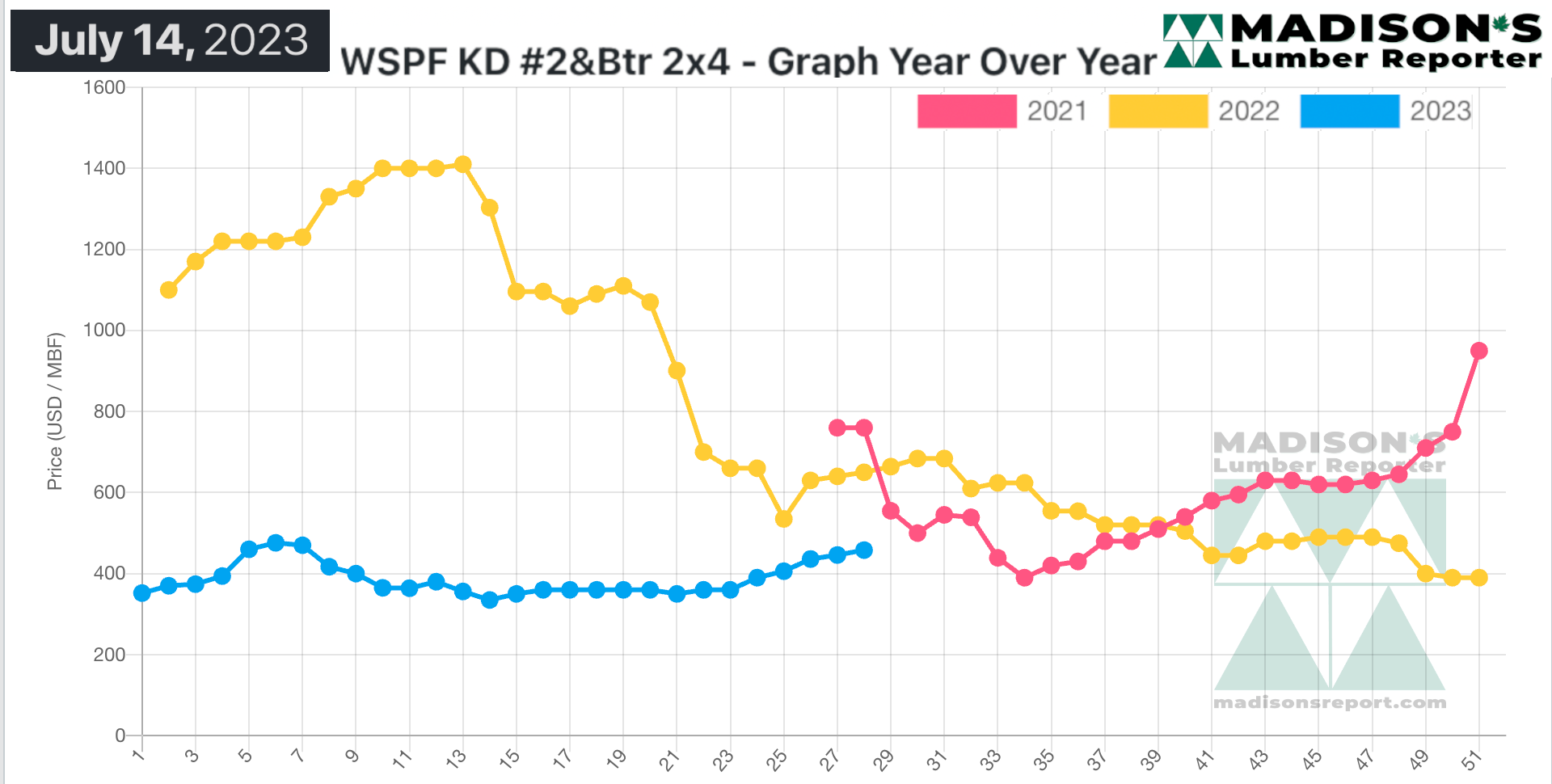

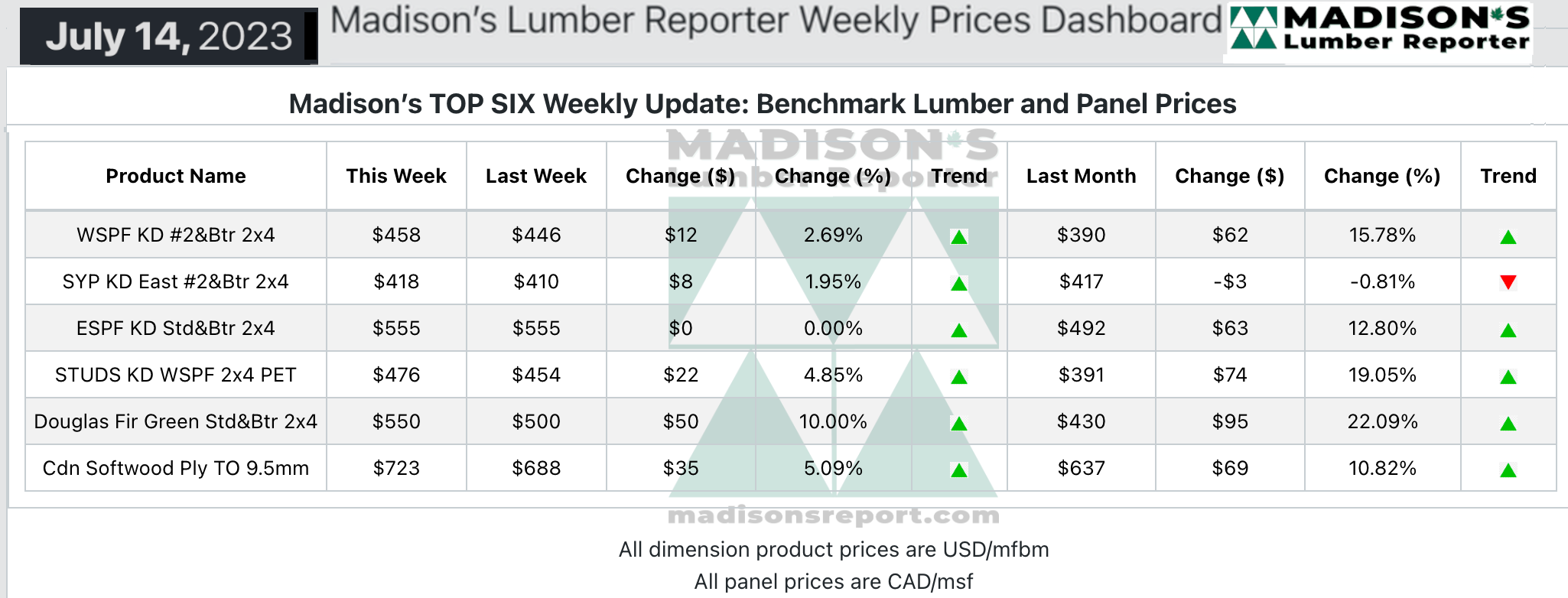

In the week ending July 14, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$458 mfbm, which is up by +$12, or +3%, from the previous week when it was $446, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is up by +$68, or +17%, from one month ago when it was $390.

Producers boosted their asking prices on most high- and standard-grade items and received little-to-no pushback from downstream buyers.

“Demand for all solid wood commodity groups once again showed palpable strength. Players considered the upcoming Canadian and American national holidays to be the next major market litmus test.” — Madison’s Lumber Reporter

Strong sales of Western S-P-F persisted, according to traders in the United States. Bread-and-butter dimension items and stud trims continued to sell with aplomb among both primary and secondary suppliers, whittling sawmill inventory down and cleaning out much of the more readily available material held by distributers. Resultant sawmill order files were into the last week of July and pushing early August. Demand for low grade was so-so compared with #2&Btr, but holding firm.

Suppliers of Western S-P-F lumber in Western Canada reported a more measured pace to business as the frantic nature of the previous week’s sales push died down somewhat. The significant discrepancy between supply and demand remained however, with the latter far outstripping the former. Availability at the sawmill level was scanty compared to the distribution network, and asking prices continued to rise in both camps. Sales activity came in spurts near the end of the week as many buyers jumped in to cover their short term needs in advance of the upcoming Canada Day holiday weekend. With July 1st falling on a Saturday, plenty of companies were taking the Friday off instead of the Monday, or vice versa. Sawmills confidently maintained order files into the back half of July.

“Demand for Western S-P-F studs remained on a solidly upward trajectory according to suppliers in Western Canada. Studs producers had established three- to four-week order files with ease over the past 10 business days, with stud mill lists growing thinner by the day. Traders noted that overall supply of WSPF studs was one of the categories most affected by shutdowns and curtailments related to the ongoing wildfires in Western Canada. Resultant asking prices continued to climb in most trims this week.” — Madison’s Lumber Reporter

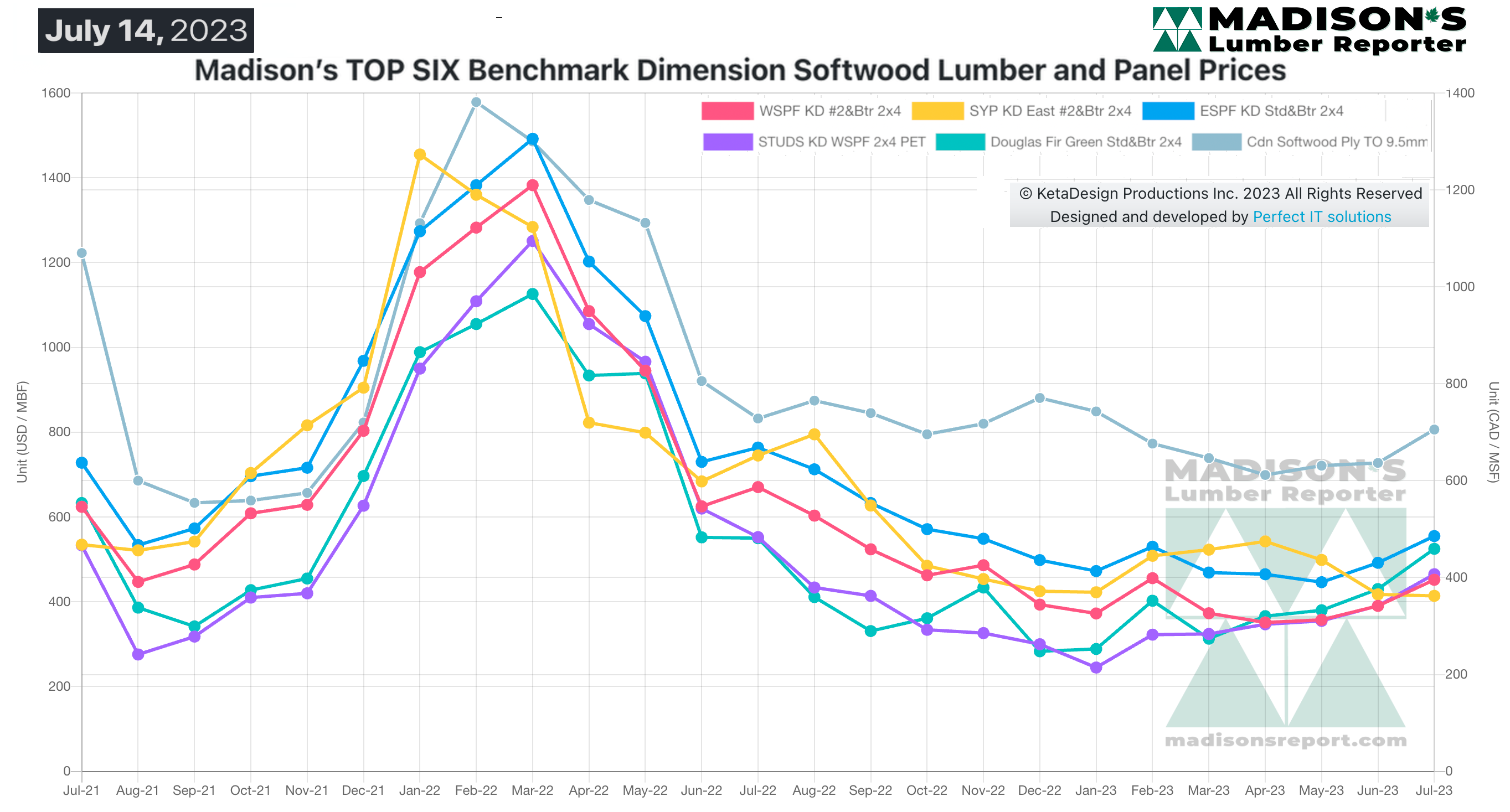

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages

Compared to the same week last year, when it was US$650 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending July 14, 2023 was down by -$192, or -30%. Compared to two years ago when it was $760, that week’s price is down by -$302, or -40%.

About Madison’s Lumber Reporter

Established in 1952, Madison’s Lumber Prices is your premiere source for North American softwood lumber news, prices, industry insight, and industry contacts. The weekly Madison’s Lumber Reporter publishes current Canadian and US construction framing dimension lumber and panel wholesaler pricing information 50 weeks a year and access to historical pricing as well.

Contact:

Keta Kosman – Publisher, Madison’s Lumber Reporter – (604) 319-2266 –www.madisonsreport.com

Source: Madison’s Lumber Reporter