Atlas Engineered Products Reports Third Quarter 2023 Financial and Operating Results

Atlas Engineered Products (“AEP” or the “Company”) (TSX-V: AEP; OTC Markets: APEUF) is pleased to announce its financial and operating results for the three and nine months ended September 30, 2023. All amounts are presented in Canadian dollars.

“The continued interest rate hikes and their effects on our industry have resulted in a more competitive market for the company’s products where some contractors are putting their building projects on pause until there is more certainty around the direction of interest rates.,” said Hadi Abassi, the Company’s CEO, President and Founder. “Despite the effect of higher interest rates, there is an ongoing need for more housing in Canada and we strive to be the partner of choice for contractors and homeowners during their construction projects.”

Financial Highlights for Q3 2023

· During the third quarter of 2023, the Company acquired Léon Chouinard et Fils Co. Ltd./Ltée. (“LCF”) located in New Brunswick, Canada. The shares of LCF were acquired for $26 million in cash plus an initial working capital adjustment of $2,884,737. An additional working capital adjustment will be finalized by the end of the fourth quarter. The land and buildings of LCF were also acquired by the Company for their appraised value of $2.792 million in cash. The Company financed the LCF acquisition with a term loan and mortgage for $22.4 million, issuing 1,739,129 common shares at a value of $2 million, and the rest with the Company’s existing cash generated from operations. During LCF’s last fiscal year ended December 31, 2022, they earned revenues of just over $25.7 million, net income of just over $6.3 million, and a non-IFRS normalized EBITDA of approximately $9.47 million, resulting in a normalized EBITDA margin of 37%.

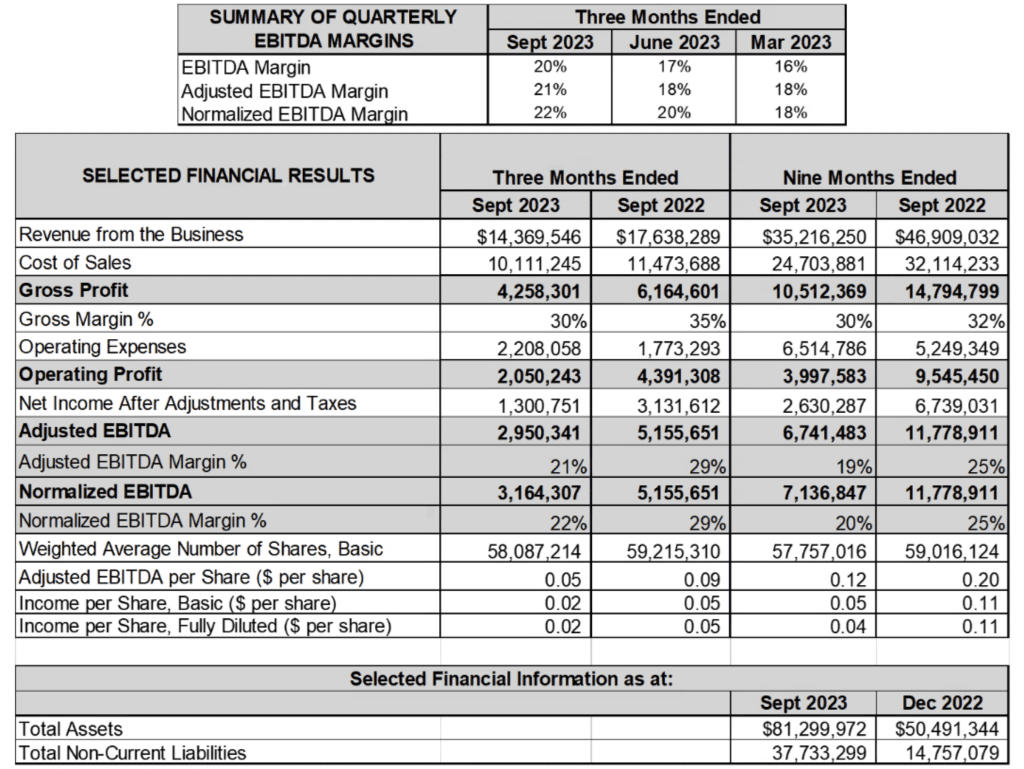

· Revenue for the nine months ended September 30, 2023 was $35,216,250 compared to revenue of $46,909,032 for the nine months ended September 30, 2022. Revenues decreased due to some material prices (ie: lumber & I-Joist) that are passed along to to customers stabilizing at significantly lower prices than the prior two years. The market has also seen a slowdown in some areas of Canada, mainly Ontario and recently the slowdown has been seen in British Columbia as well. This has mainly been due to rising interest rates resulting in the construction industry pausing to assess affects on new housing demand, which has led to reduced housing starts. The Company expects this slowdown to be short-term in nature and that markets will strengthen as they adjust to current market conditions and increased demand due to significant population growth and the ongoing housing deficit.

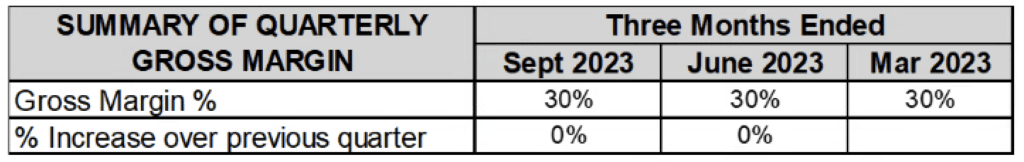

· Gross margin for the nine months ended September 30, 2023 was 30%, which is lower than gross margin of 32% for the nine months ended September 30, 2022. Gross margins decreased due to the more competitive market for sales that is driven by the significantly lower cost of lumber compared to the prior period. Closer to the end of the nine months ended September 30, 2023, the Company had to find a balance between generating sales and compromising slightly on the gross margin available in a more competitive market. The Company continues to focus on gross margins as well as revenue generation. Typically, the Company has an increase in gross margins for the third quarter, but due to the competitive market, lower lumber prices and demand not increasing the Company had to lower gross margins slightly in order to generate more revenues. The Company was still able to maintain consistent gross margins for fiscal 2023 as seen in the table below.

· Operating expenses increased by $1,265,437 for the nine months ended September 30, 2023 compared to the nine months ended September 30, 2022. 34% of this increase is due to non-cash items of depreciation and amortization and share based payments. 31% of this increase is related to one time, non-recurring cash outlay expenses incurred in relation to the acquisition of Léon Chouinard et Fils Co. Ltd./Ltée. (“LCF”) announced on August 23rd, 2023. The anticipated acquisition of LCF led the Company to bolster human resources and systems to ensure the Company was ready and able to handle the resulting growth and geographical expansion and continue with future acquisitive growth which accounts for the remaining increase in operating expenses.

· Net income after taxes was $2,630,287 for the nine months ended September 30, 2023 compared to a net income after taxes of $6,739,031 for the nine months ended September 30, 2022. The Company recorded a lower net income after taxes in the current period mainly due to decreased revenues, decreased gross margins, and increased operating expenses.

· Non-IFRS measure normalized EBITDA margin decreased to 20% for the nine months ended September 30, 2023 from 25% for the nine months ended September 30, 2022. These decreases were mainly due to decreased gross margins and increased operating costs. Some acquisition costs have been added back to normalized EBITDA, but additional support costs for the Company’s growth were not added back as these will be ongoing costs moving forward. The table below demonstrates how the additional support required impacted these margins in the first and second quarter, but these EBITDA margins have risen as results from LCF were included in the third quarter from the acquisition date of August 23, 2023 that offset the additional costs required for growth.

Outlook for 2023

The Company is continuing to operate in a more competitive market during 2023 as interest rates have risen in an effort to slow inflation. The Company currently anticipates that increased interest rates will have a minimal overall affect on the long-term housing market after the initial impact of the increase is absorbed by the market. The number of homes that are needed to support Canada’s continued population growth and immigration continues to be significant. The Company will continue to monitor the effects of interest rates on the housing market, and is prepared to manage pricing and explore new markets in order to continue to drive organic growth as much as possible during fiscal 2023.

Reduced raw material costs, such as lumber and I-Joists, continue to impact the Company’s revenues. These costs are passed along directly to the customer and will result in decreased sales prices to the customer as input costs decrease. Average lumber and I-Joist prices have decreased by roughly 50% for the nine months ended September 30, 2023 compared to the nine months ended September 30, 2022.

The Company’s large order announced on March 9, 2023 was delayed in Quarter 1. Part of this order was delivered in Quarter 2 and 3 of 2023, with the rest to be delivered in Quarter 4 of 2023 and Quarter 1 of 2024. Permit and construction delays have caused postponements in these deliveries that were outside the Company’s control.

The recent acquisition of LCF is a great addition to the AEP group and acquisitions remains a key part of AEP’s long term strategic goals. The Company has built a strong pipeline of M&A opportunities and will continue to assess more M&A opportunities that fit within the Company’s goals and strategies, while also working to bring in the latest automation to improve operational efficiencies, and adding new products and services to better serve our customers.

For the complete press release, click here.

About Atlas Engineered Products Ltd.

AEP is a growth company that is acquiring and operating profitable, well-established operations in Canada’s truss and engineered products industry. We have a well-defined and disciplined acquisition and operating growth strategy enabling us to scale aggressively and apply new technologies, giving us a unique opportunity to consolidate a fragmented industry of independent operators.

Contact:

Jake Bouma – Representative for AEP – (604) 317-3936 – jake.bouma@atlasaep.ca

Source: Atlas Engineered Products Ltd.