Credit scores have been in use for many years; primarily, in the consumer credit field.

Blue Book Scores, our proprietary scoring system developed by Blue Book Services, are assigned to listed companies who buy lumber and lumber products. A score predicts the likelihood of a negative credit event — default or delinquent on payment — within a 12 month period of time.

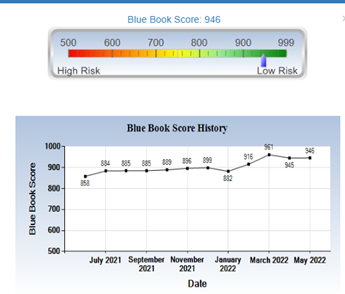

A powerful tool for sellers, Blue Book Scores complement a company’s rating and comprehensive business report. Scores range between 500 and 999, with 999 being the highest score. Higher scores represent a less likely credit event – delinquent or default on payment — will occur. The lower the score, the more likely a company will be delinquent or default on payment.

Blue Book Scores are available on the Blue Book Online Services website and mobile app. A graphical display of how a company’s Blue Book Score is trending is provided on the Blue Book Online Services website, in the Business Report or by contacting a customer service representative.

Blue Book Scores – one more way to help you make informed and confident business decisions!

If you’re interested in learning more about how Blue Book Membership can help you and your business, click here or contact a Blue Book Services Representative.